Agentic trading, divided into chambers.

Divide Engine builds polymarket agents as isolated "divides" — sealed branches that analyze, test, and execute before merging back into one strategy layer.

Market Divide Analysis

Compare parallel theses across multiple polymarket views.

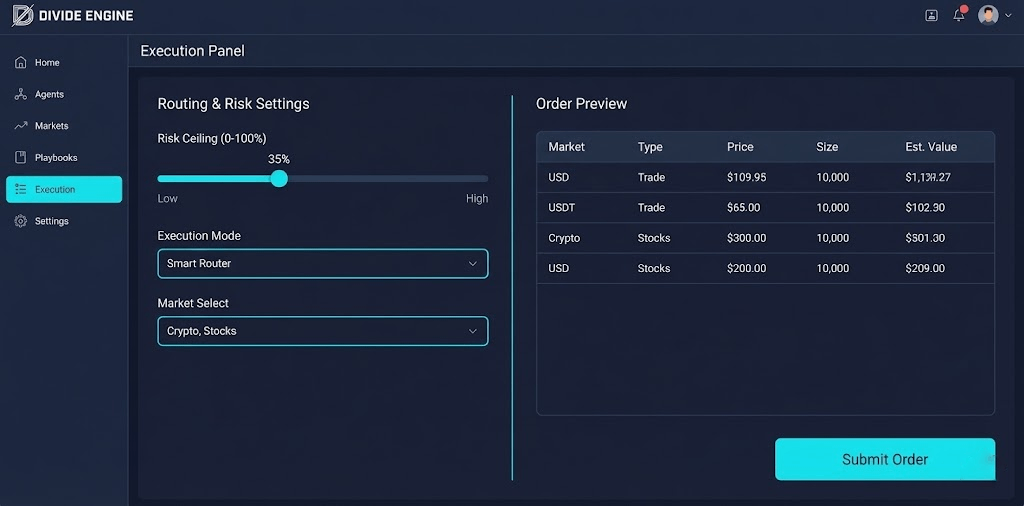

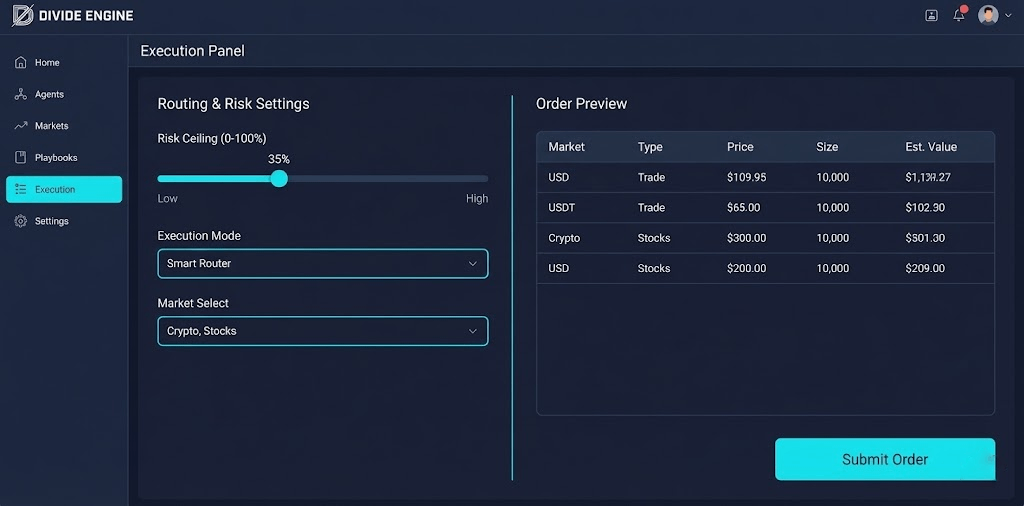

Execution Rail

Route agent outputs into signals or live execution with guardrails.

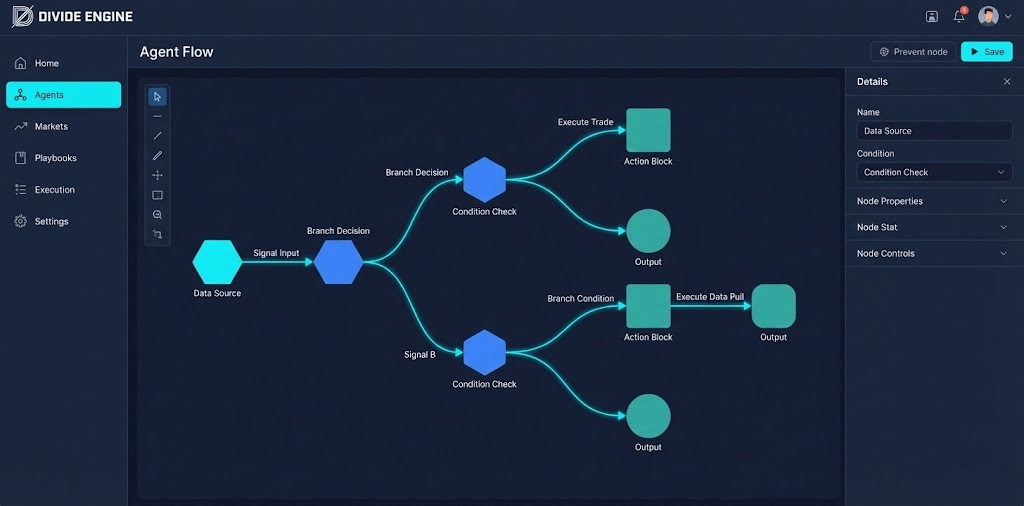

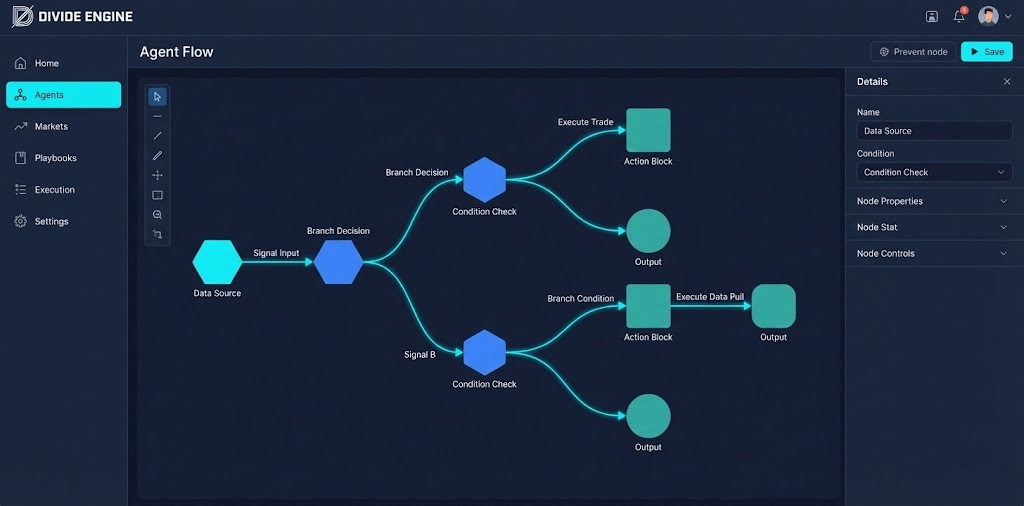

Branching Agent Canvas

Design branching agent workflows that run in isolated divides.

Agent Playbooks

Save and redeploy proven agent configurations.

Market Divide Analysis

Compare parallel theses across multiple polymarket views.

Execution Rail

Route agent outputs into signals or live execution with guardrails.

Branching Agent Canvas

Design branching agent workflows that run in isolated divides.

Agent Playbooks

Save and redeploy proven agent configurations.

Where prediction markets meet sealed intelligence.

Divide Engine is a multi-agent polymarket trading builder. Each agent lives in an isolated computational divide, analyzing odds, liquidity, and narrative flow in real time. The Engine reconciles those branches into a single execution layer you can control, throttle, or simply observe.

Live Market Intelligence

Track probabilities, volume, and momentum across active Polymarket events.

$DVDE · Protocol & Token Overview

A coordination layer for agentic polymarket trading.

01What is Divide Engine?

Divide Engine is an agentic polymarket trading system that lets users design, test, and deploy autonomous agents across prediction markets. Each agent operates in an isolated divide, running its own analysis pipeline on market probabilities, depth, history, and external signals. The platform then reconciles these divides into a unified plan that can emit signals or execute under strict risk parameters.

02$DVDE Token Utility

- ×Gated access to advanced agent features, deeper backtesting, and higher parallelism.

- ×Reduced protocol fees and routing costs for DVDE stakers.

- ×Governance over risk presets, new agent templates, and integrated venues.

- ×Incentives for community-built agents and strategy modules.

03Economic Model

Protocol Fees

A portion of execution fees and routing spread flows back into the DVDE treasury.

Staking & Priority

Staked DVDE unlocks priority compute, faster backtests, and early experimental features.

Burn / Sink Mechanisms

Governance may vote to direct parts of protocol revenue toward DVDE buyback or burn events.

04Roadmap

core agent canvas, manual deployments.

playbook library, basic execution rail, more metrics.

support more prediction markets and new agent archetypes.

DVDE token holders steer fees, features, and integrations.